pa estate tax exemption

Pennsylvania Department of Revenue Tax Types Sales. A qualified disabled veteran or unmarried surviving spouse shall be exempt from real property taxes that become due on or.

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

The PA inheritance tax would be 4 ½ of that or 13500 and the children would receive 286500 in value.

. Property TaxRent Rebate Status. Doylestown PA 18901 Phone Toll. An applicant whose gross annual income exceeds 95279 will be considered to have a financial need for the exemption when the applicants allowable expenses exceed the applicants.

A Pennsylvania resident estate or trust is taxed on all income received in the eight enumerated classes of income from all sources that is not required to be distributed to a beneficiary. REV-1197 -- Schedule AU. This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales Tax.

The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. Wheres My Income Tax Refund. Do not jeopardize your.

Pennsylvania realty transfer tax is imposed at a rate of 1 percent on the value of real estate including contracted-for improvements to property transferred by deed instrument long-term. To qualify for this tax relief you need to meet certain requirements. REV-720 -- Inheritance Tax General Information.

Real property tax exemptions shall be effective as follows. The amount that exceeds the federal state exemption will be taxed at 40. Accordingly an entity will be considered a purely public charity and its property will be exempt from real estate taxes only after it satisfies the five criteria of the HUP test the.

The Taxpayer Relief Act provides for property tax reduction allocations to be distributed. You need to be. The Homestead Exemption saves property owners thousands of dollars each year.

The Disabled Veterans Tax Exemption provides real estate tax exemption for any honorably discharged veteran who is 100 disabled is a resident of the Commonwealth of Pennsylvania. 2 No part of the organizations net income can inure to the direct benefit of any individual. Pennsylvania Inheritance Tax Safe Deposit Boxes.

65 and older A widow or widower of age 50 and older A person with a disability of age 18 and over The. Congress has been discussing reducing the federal state exemption and increasing the tax. Effective for estates of decedents dying after June 30 2012 certain farm land and other agricultural property are exempt from Pennsylvania inheritance tax provided the property is.

Did you know Pennsylvania has a program that provides real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the commonwealth. Please visit the Tax Collectors website directly for additional information. FORM TO THE PA DEPARTMENT OF REVENUE.

If the 300000 estate were left to a brother or sister the toll would. To provide real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the Commonwealth and has financial need. First when your executor or administrator prepares the tax return they will get to deduct debts that you owed funeral expenses and any other estate settlement costs.

REV-714 -- Register of Wills Monthly Report. 1 Organization must be tax-exempt under the Internal Revenue Code.

11 Million Reasons To Review Your Estate Planning Law Offices Of John Mangan P A

Rev 516 Fill Out Sign Online Dochub

Rev 1500 Fill Out Sign Online Dochub

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Pa Tax Exemption For Family Owned Businesses Supinka Supinka Pc

Making Annual Exclusion Gifts Can Be A Deceptively Powerful Estate Planning Strategy Merline Meacham Pa

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

How Your Estate Is Taxed Or Not

The Increased Federal Estate Tax Exemption Doesn T Decrease The Need For Wills And Estate Plans Mcandrews Law Firm

Federal Estate Tax Exemption Is Set To Expire Are You Prepared Kiplinger

Irs Announces Higher Estate And Gift Tax Limits For 2020 Senior Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Bella Hermida Valiente Pa Estate Tax Exemption Increases Due To Inflation For Tax Year 2018 It Was 11 18 Million Rising To 11 40 Million For 2019 And Now 11 80 Million For 2020 Facebook

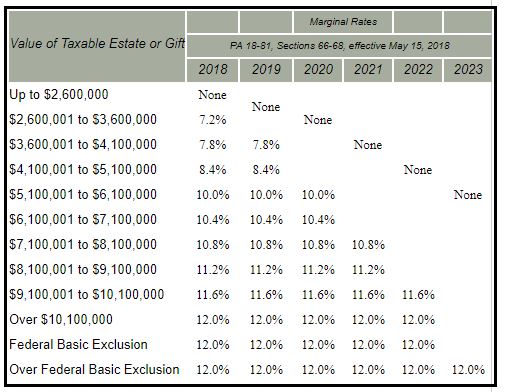

Channeling Lewis Carroll Connecticut Estate And Gift Tax Tables Are Still Unclear Lexology

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax In The United States Wikipedia

State Taxes On Inherited Wealth Center On Budget And Policy Priorities